One of the most common questions business owners ask is — how much does GST registration cost in India? Many people believe GST registration is expensive, while others think it is completely free. The truth lies somewhere in between.

Understanding GST registration fees in India is important before you apply, because choosing the wrong option can lead to rejection, delays, or repeated applications. In this guide, we explain the actual government cost, professional service charges, and what you should expect during the registration process.

Whether you are a shop owner, freelancer, home business, or online seller, this article will help you make a safe and informed decision before applying for GST registration.

If you want to understand the complete GST registration process, documents, eligibility rules, and timelines, you should also read our detailed guide on GST registration in India for small businesses.

If you are selling on Amazon, Flipkart, Meesho or Instagram, GST is mandatory even if your sales are low.

Table of Contents

Is GST Registration Free from Government in India?

Yes, GST registration is completely free on the government portal. The GST department does not charge any application fee, stamp duty, or processing charges for issuing a GST number.

Any business owner can apply directly on the GST portal without paying government fees. This is officially confirmed by the GST department.

As per official GST guidelines, registration can be done directly on the GST portal without any government charges.

Some small businesses are confused about whether they actually need GST based on their turnover.

Why Do Agents Charge Fees for GST Registration?

Although the government does not charge any fee, GST registration is a technical process that requires correct documentation, portal filing, and responding to verification queries. Many business owners prefer professional help to avoid mistakes.

- Document verification

- Form filling and portal submission

- OTP verification assistance

- Handling officer queries

- Follow-ups until approval

GST Registration Fees in India: How Much Do Agents Charge?

GST registration service charges in India generally range between ₹499 to ₹3,000 or more depending on business type and complexity.

- Proprietorship – lower cost

- Partnership firms – moderate cost

- Companies / LLP – higher cost

- Address or document issues – additional work

Is Cheap GST Registration Safe?

Very cheap GST registration services often skip proper verification. This may result in incorrect filing, which can later cause GST notices, rejection, or even cancellation of registration.

Choosing professional assistance ensures proper documentation, correct category selection, and faster approval without complications.

Hidden Costs of Wrong GST Filing

Many business owners end up paying more when GST applications are rejected or need re-submission. Wrong filings may lead to legal notices, delayed approvals, and repeated applications.

GST authorities can initiate verification or issue notices if information is incorrect, as per compliance rules issued by tax authorities.

- Application rejection

- Re-verification delays

- Missed business opportunities

- Risk of penalties later

Registering under MSME can also help businesses access loans and government schemes.

How to Choose the Right GST Registration Service Provider

When selecting a GST registration service, businesses should focus on reliability instead of only price.

Check if the service provider offers document verification, post-filing support, and assistance in case of notice from GST department. Transparent communication and clear pricing are also important indicators of professional service.

Cases Where GST Registration Fees Increase

Some applications require additional verification and paperwork, which increases service cost.

- Multiple business partners

- Company or LLP structure

- Address mismatch

- Old PAN or Aadhaar issues

If you are running a small shop or retail business, there are special GST rules you must follow before applying.

Situations Where GST Registration Cost Increases Further

Certain business situations involve more compliance checks and communication with GST officers, which can increase service workload.

- Multiple business locations

- Previous GST cancellation history

- High-risk business category

- Incorrect business classification

- Verification visits by GST officers

Small retail shops and local businesses often face different GST rules and exemptions that should be understood before applying.

DIY vs Professional GST Registration

While GST registration can be done directly on the portal, many first-time applicants struggle with form selection, business classification, and document uploads.

Freelancers and service providers often select wrong business type during self-registration, which leads to compliance issues later.

- DIY registration has no guided support

- Errors can delay approval

- Professional service ensures correct filing

- Expert help handles officer queries

Does Paying More Guarantee Faster GST Approval?

Paying higher service charges does not directly influence GST approval speed. Approval depends on correct documents, Aadhaar verification, and officer workload.

However, professional services reduce delays by ensuring correct filing the first time and responding quickly to officer queries if raised.

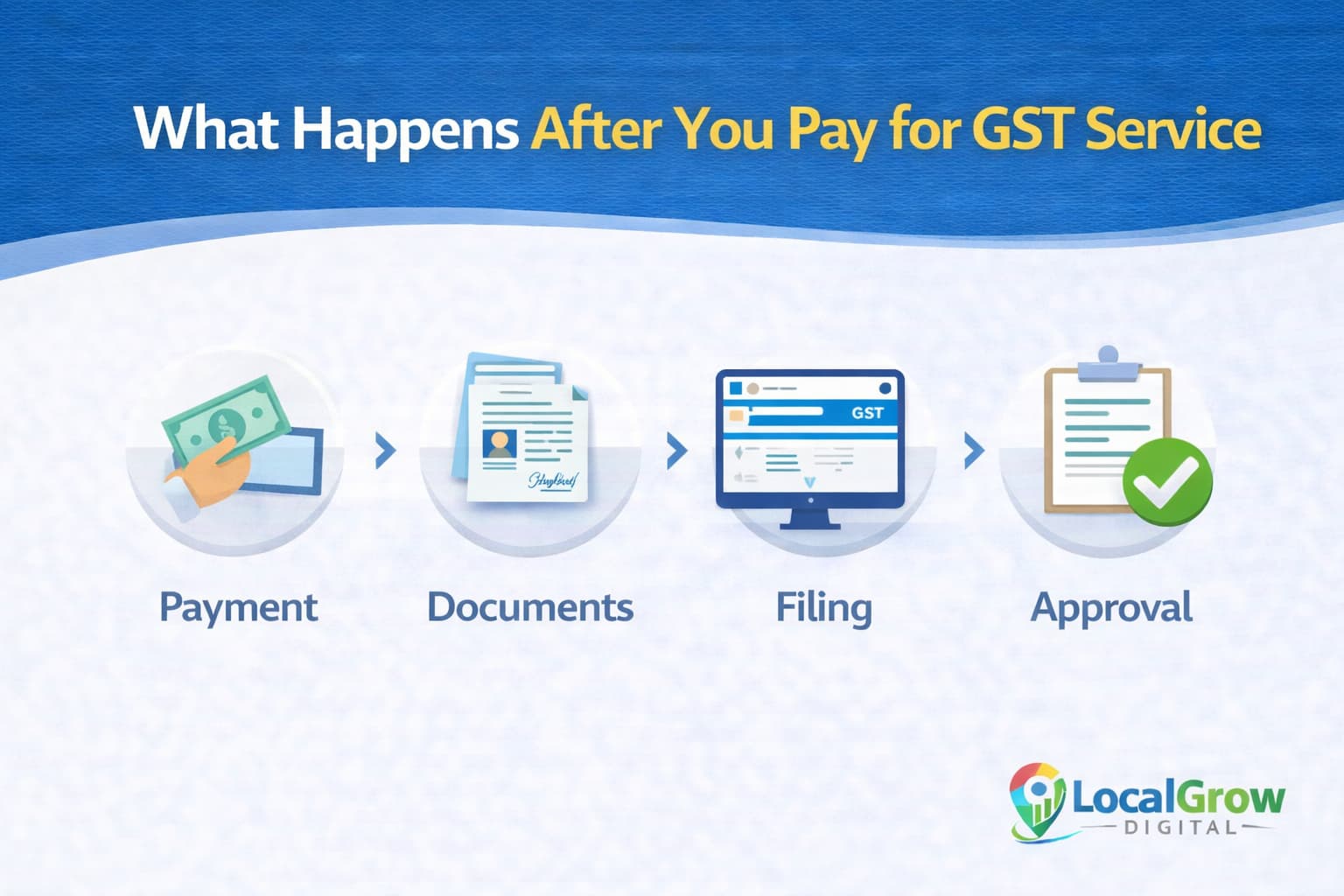

What Do You Get in Professional GST Registration Service?

Professional GST registration services provide end-to-end assistance from document verification to final GST number approval.

- Document checklist and verification

- Online portal filing

- OTP and Aadhaar verification help

- Application tracking

- Support until GST certificate is issued

Preparing the correct documents before applying reduces rejection risk and speeds up approval.

Start Your GST Registration in India at the Right Fees

Avoid rejection, delays, and portal confusion by letting experts handle your GST registration correctly from the start.

Our GST experts verify your documents, select the correct business category, and handle the complete filing process so you do not face rejection or delays.

Frequently Asked Questions on GST Registration Fees

Is GST registration completely free?

Yes, government does not charge any fee for GST registration.

Why do agents charge for GST registration?

Charges cover document verification, filing, and approval support.

Can I apply GST myself?

Yes, but portal errors may delay approval.

What is average GST registration cost?

Usually between ₹499 to ₹3,000 depending on complexity.

Are cheap GST services risky?

Yes, wrong filing can cause rejection and notices.

Do companies pay higher GST registration fees?

Yes, company and LLP filings need more documents.

Does address mismatch increase cost?

Yes, verification takes longer and needs correction.

How long does approval take?

Usually 3–7 working days if documents are correct.

Can GST be rejected?

Yes, if documents are wrong or incomplete.

Is MSME required for GST?

No, MSME is optional but beneficial.

Do online sellers need GST even with low sales?

Yes, marketplace sellers must have GST.

Can GST be cancelled later?

Yes, voluntary cancellation is allowed.

Does agent fee include notice reply?

Professional services usually include support.

Is GST required for home businesses?

Yes, if turnover or business type requires.

Is WhatsApp support available for guidance?

Yes, expert assistance is available on WhatsApp.